[ad_1]

Over the previous few weeks, I’ve been stating conflicting rotations for sectors on Relative Rotation Graphs, the unfavourable divergence between RSI and SPY, and some extra arguments that sign warning.

With regard to the S&P that has not paid off…. but. The US inventory market, extra particularly the S&P 500 saved creeping larger lately. A lot to my, and lots of others, frustration.

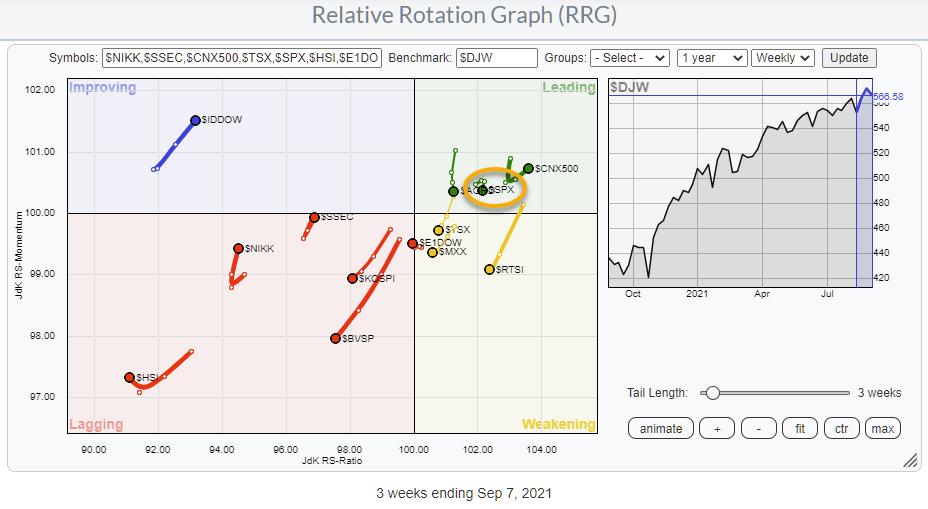

Nevertheless, for those who take a step again and try the massive(ger) image. This, by the best way, is precisely what Relative Rotation Graphs assist you to to do. A case may be made that the US/SPY, is the odd one out. An necessary one clearly because the US market is the most important chunk in each world index.

The benchmark for this RRG is the DJ International index, and though the listing of indexes on the plot just isn’t utterly overlaying the members of the benchmark we will clearly see the focus of markets contained in the pink, lagging, quadrant in addition to the dominant-negative RRG-Heading.

Most of those markets are displaying fairly weak charts, lots of them together with a robust unfavourable divergence between worth and RSI, in addition to MACD/PPO.

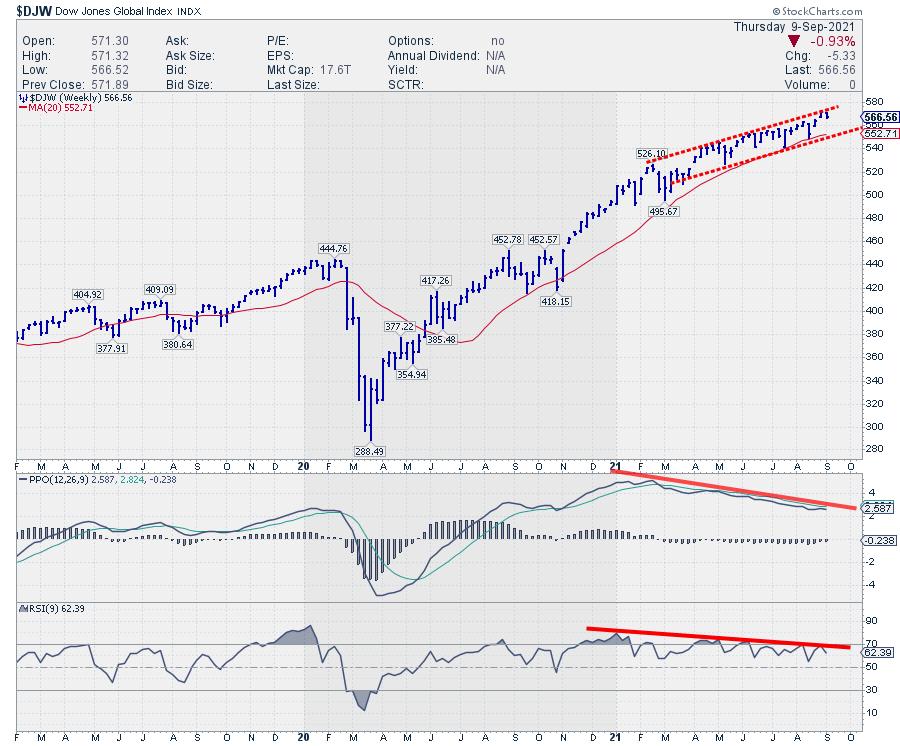

The chart on the high of this text is the Dow Jones International index and the divergence that’s displaying up on this chart is getting stronger by the week and it’s already build up for the reason that begin of the 12 months.

Now, a unfavourable divergence by itself just isn’t sufficient to tug the set off. An “occasion” on the value chart is required to make that divergence significant. And for the worldwide inventory market index, I’m taking a look at a break beneath the 20-week MA which is in the meanwhile coinciding with a rising assist line round 550.

With the US contained in the main quadrant at a really brief tail, it actually appears just like the US is holding up the world. The query is for the way lengthy?

There are a number of extra attention-grabbing tails on this RRG which I’m planning to debate in my ChartWatchers article this upcoming weekend.

#StaySafe, –Julius

My common weblog is the RRG Charts weblog. If you want to obtain a notification when a brand new article is printed there, “Subscribe” together with your e-mail tackle.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Host of: Sector Spotlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll actually learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Learn More

Subscribe to Do not Ignore This Chart! to be notified at any time when a brand new submit is added to this weblog!

[ad_2]

Source link