[ad_1]

Congratulations! We have made it by means of the primary 10 days of September principally unscathed. On the time of this writing, the S&P 500 is down barely greater than 0.50% month-to-date. Momentum stays pretty robust, the pattern is up, so why ought to we fear? Properly, let’s solid apart the historic penalties of September for a second and easily give attention to subsequent week – choices expiration week.

Choices Expiration Impact

When the inventory market rises regularly, there may be sometimes a TON of internet in-the-money name premium on the desk as we method earnings expiration Friday every calendar month. Whereas I would suspect that market makers go lengthy particular person shares to guard themselves as they promote calls to retail patrons, there’s nonetheless the chance to earn money on the lengthy facet with these shares as they transfer larger into choices expiration, then promote their positions and even start shorting to create overhead provide. This very short-term provide vs. demand imbalance sends shares decrease and market makers money in on the quick facet. In order that they earn money on their lengthy positions as shares rise, then take these earnings by promoting and create short-term oversupply from shorting and earning profits as costs drop. And guess what? That fall in value eliminates important quantities of internet in-the-money name premium. It is a magic present and market makers are Houdini.

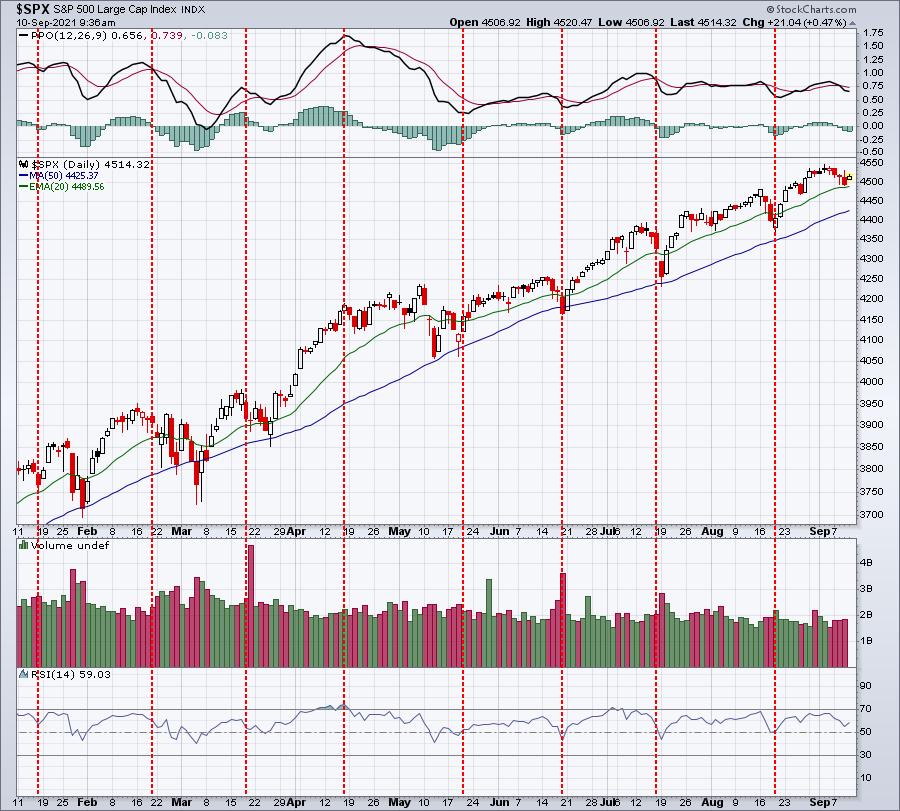

Visually, you may see it happen practically each month in 2021. Here is a 1-year chart of the S&P 500:

The red-dotted vertical traces spotlight Friday choices expiration day every month. Simply take a second to take a look at the place many of the revenue taking happens. It is both simply earlier than choices expiration…..or typically simply after. For those who’re asking why would promoting happen after choices expire, you’ll want to merely remind your self of what occurs at choices expiration. Name patrons have the choice of exercising their choices and shopping for the inventory at their strike value. Market makers, who offered the decision, grow to be quick sellers of that safety when calls are exercised. They earn money when the inventory later strikes decrease, and that is why the inventory market can wrestle through the week after choices expire.

Since 1950, the S&P 500 has produced annualized returns as follows all through the calendar month (all calendar months, not simply September):

- twenty sixth by means of sixth: +21.77%

- seventh by means of tenth: -4.04%

- eleventh by means of 18th: +13.29%

- nineteenth by means of twenty fifth: -8.51%

There’s an ABSOLUTE sample that has been in play for DECADES. Ignore it at your individual threat. I’ve mentioned the reasoning behind these buying and selling patterns in different articles.

Once more, congratulations to all for escaping the wrath of September to this point, however simply understand that one issue that hasn’t kicked in simply but is choices expiration. That is subsequent week, so any prolonged promoting, in my view, will doubtless happen over the subsequent 1-2 weeks primarily based on historic efficiency round month-to-month choices expiration.

September Historical past

Okay, fasten your seat belts as a result of this is not fairly. The very first thing to grasp about September is that it is the solely calendar month that has ended decrease than it started extra usually than the opposite method round. September has completed the month larger 32 instances and decrease 38 instances over the previous 70 years. So these odds alone counsel we’ve got the next chance of transferring decrease, proper? Even through the present secular bull market, which I consider began on April 10, 2013, the day that the S&P 500 cleared the double high from 2000 and 2007, September has offered challenges. Since 2013, September has ended larger 4 instances and decrease 4 instances. The typical return has been -0.15%. Take into account that we have been in a wonderful bull market since 2013, regardless of struggling by means of two cyclical bear markets (This fall 2018 commerce struggle and the pandemic-related 2020 selloff). The one calendar month that is been worse than September through the present secular bull market has been March.

However not every single day or week in September has carried out equally. The truth is, since 1950, here is the annualized return in September, damaged down by the primary and second halves:

- September 1-16: +9.98%

- September 17-30: -22.49%

If we take a look at the present secular bull market (2013-2020), the annualized returns for these identical two intervals is as follows:

- September 1-16: +12.54%

- September 17-30: -15.34%

So whereas we have been on this very bullish secular bull market, the September “first half vs. second half” sample has continued. It is a cause to at the least be cautious, particularly as method the tip of subsequent week (subsequent Friday – choices expiration day – is September seventeenth, which marks the start of this bearish 2nd half of September interval).

However even throughout the “second half” of September, the really bearish interval runs from September twentieth by means of September twenty sixth. That marks the ONLY 7 consecutive-day interval all year long the place annualized returns are adverse EVERY day. The annualized return only for these 7 calendar days?

- Since 1950: -38.89%

- Since 2013 (present secular bull market interval): -36.46%

Defending Towards September Weak point

The apparent query, after digesting all the above info, is “what ought to we do to guard ourselves and our portfolios?” First, let me say that historical past doesn’t assure us something. There have been years when September has not been bearish in any respect. Through the late-Nineties secular bull market, September was stellar, rising yearly from 1995 by means of 1998. Whereas the September twentieth by means of September twenty sixth interval, total, has been extraordinarily bearish, there have been exceptions to the rule. And whereas the S&P 500 has dropped 7 of 8 years since 2013 throughout that September twentieth by means of September twenty sixth interval, many of the drops have been 1% or much less. That equates to maybe a 45-point drop within the S&P 500, so I am not speaking about an upcoming crash. It is simply that the tendency has clearly been to the draw back.

If this downward tendency is regarding to you, there are methods to mitigate the chance. The primary and most evident method is to easily construct money across the center of the month, so that you’ve much less publicity. If you wish to stay invested, then presumably take into account the historic efficiency of the assorted sectors. I calculated the annualized returns of all sectors through the September intervals I have been discussing, however solely through the secular bull market since 2013, so we are able to examine these sector outcomes in opposition to the benchmark S&P 500. Let’s begin with the primary half vs. second half of September – annualized returns (the S&P 500 return is in daring for comparability functions):

September 1-16:

- Industrials (XLI): +50.30%

- Supplies (XLB): +33.14%

- Well being Care (XLV): +25.48%

- Financials (XLF): +23.03%

- Power (XLE): +17.06%

- Client Staples (XLP): +14.65%

- Client Discretionary (XLY): +14.43%

- S&P 500 ($SPX): +12.54%

- Utilities (XLU): +7.68%

- Actual property (XLRE): +5.22%

- Communication Companies (XLC): +4.26%

- Expertise (XLK): -2.73%

September 17-30:

- Expertise (XLK): -5.32%

- Client Discretionary (XLY): -13.35%

- Utilities (XLU): -13.75%

- S&P 500 ($SPX): -15.34%

- Communication Companies (XLC): -15.70%

- Actual Property (XLRE): -17.67%

- Client Staples (XLP): -26.63%

- Industrials (XLI): -27.74%

- Financials (XLF): -31.58%

- Well being Care (XLV): -37.88%

- Supplies (XLB): -42.61%

- Power (XLE): -65.70%

There are some things that stand out to me. First, and maybe surprisingly, know-how (XLK) is the one sector that traditionally does not acquire floor within the first half of September. The second is possibly much more stunning. When S&P 500 efficiency turns ugly within the 2nd half, the XLK is the BEST performing sector by a reasonably vast margin. It is as if any promoting of know-how by retail merchants is scooped up by professionals, realizing that Q3 earnings outcomes are simply across the nook in October. My third takeaway is that investing in defensive sectors actually gives little safety as utilities (XLU) is the one defensive sector that has outperformed the benchmark in that latter half of September.

Conclusion

Based mostly on all the above, I would positively take into account some precautions over the subsequent couple weeks. Make no mistake about it, I stay VERY bullish by means of 12 months finish. Initially of 2021, I offered a 12 months finish goal of 4700 on the S&P 500 and I consider we’ll get there. I feel there’s even an out of doors shot of approaching 5000 earlier than 12 months finish. Few analysts have been extra bullish than me. However it will be irresponsible to disregard the historic tendencies that we have seen in September. For that cause, I would take into account elevating additional cash into subsequent week, particularly these with a short-term mindset. We’re prone to see important promoting sooner or later over the subsequent couple weeks primarily based on choices expiration and seasonality and I wish to have money readily available to seize some bargains on any promoting.

As we transfer into October, I absolutely anticipate that we’ll see one more pre-earnings surge in U.S. equities as firms proceed to bury income and EPS estimates which can be ridiculously low-balled.

For those who’re excited about benefiting from market maker associated manipulation round choices expiration, then take into account becoming a member of me for my month-to-month “Max Ache” webinar that can be held on Tuesday, September 14th at 4:30pm ET. Final month, we nailed a number of buying and selling candidates and we’ll be in search of one other batch of buying and selling candidates for this week. CLICK HERE to start out your FREE 30-day trial. We’ll ship out room directions to all of our members, together with trial members, on Tuesday.

We even have a free publication, our EB Digest, that is printed 3x per week. There is no bank card required and chances are you’ll unsubscribe at any time. I will be offering our neighborhood a historic buying and selling stat that every one merchants completely ought to pay attention to. Merely present us your identify and e mail handle HERE and I am going to get that publication and historic reality out to you on Monday!

Completely satisfied buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steerage to EB.com members every single day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as effectively, mixing a singular talent set to method the U.S. inventory market.

Subscribe to ChartWatchers to be notified every time a brand new submit is added to this weblog!

[ad_2]

Source link