[ad_1]

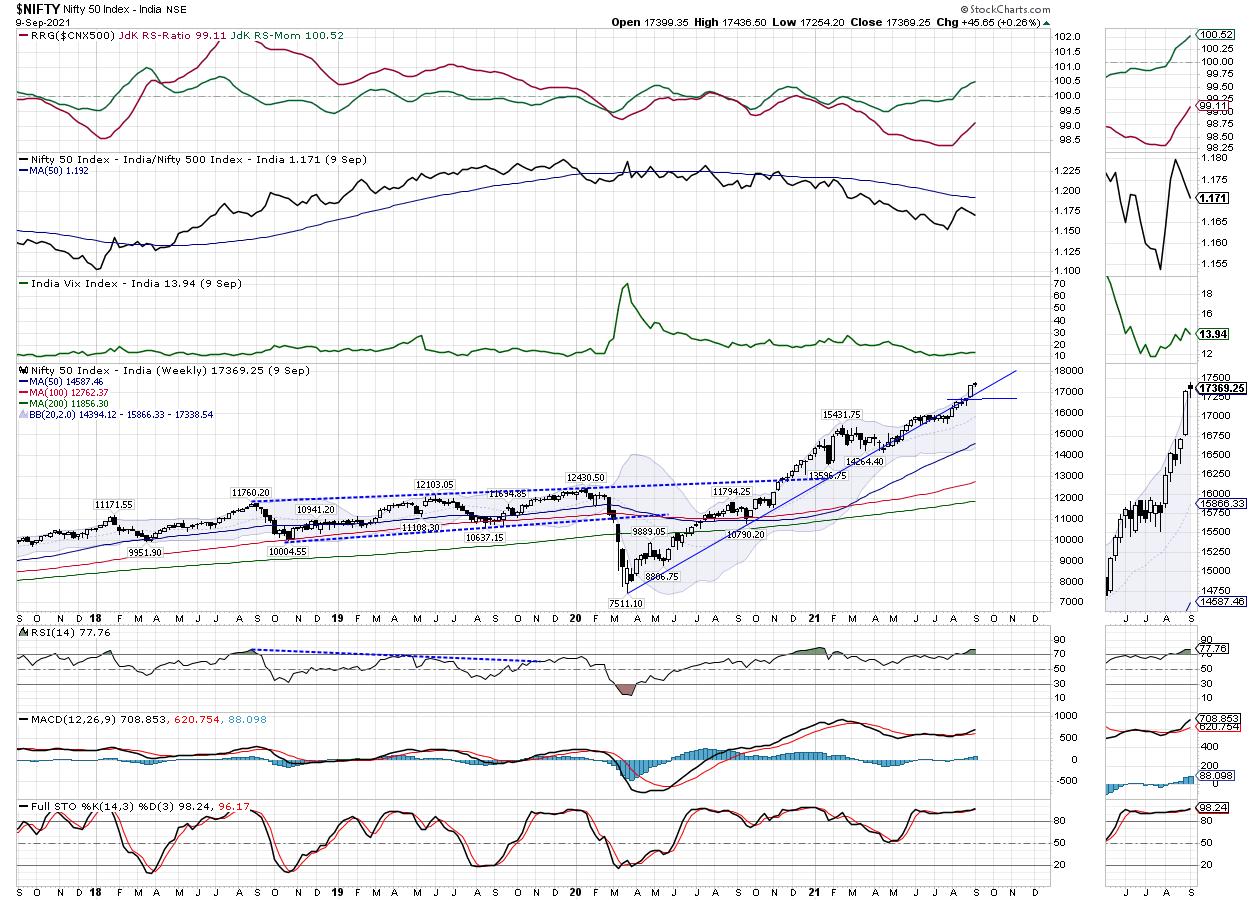

Within the earlier weekly observe, it was talked about that regardless that the NIFTY and different key indexes are grossly overbought, the choices information is continuous to indicate energy. This additionally meant that the helps had been dragged increased by the NIFTY. Whereas buying and selling on the anticipated strains, the Indian fairness markets put up a resilient present and ended the week with some modest positive factors. Regardless of being overbought, the market confirmed no intention to right over the previous 5 days. It consolidated in a slender vary, which saved the buying and selling vary for the week at simply 182 factors. Whereas the index consolidated, it closed with a acquire of 45.65 factors (+0.26%) on a weekly foundation.

The markets proceed to stay overbought on each day by day and weekly charts. Nevertheless, the undercurrents are buoyant; it is usually necessary to notice that, when the markets are in a powerful uptrend, they have a tendency to stay overbought for a while even when they consolidate. The choices information reveals that heavy PUT writing continued all through the week between 17200-17400 ranges; this makes the zone of 17000-17200 a powerful help space if a minor corrective transfer or range-bound consolidation occurs. There are not any seen probabilities of any main correction occurring; nevertheless, some ranged consolidation may be very a lot probably at present ranges.

The volatility cooled off barely; INDIAVIX got here off by 4.13% to 13.94. The approaching week may even see a constructive begin, however the ranges of 17480 and 17595 could act because the potential resistance factors at increased ranges. The helps on the decrease aspect can are available in at 17200 adopted by 17120. The buying and selling vary for the approaching week is predicted to be wider than standard.

The weekly RSI is 77.76; it stays impartial and doesn’t present any divergence towards the worth. The weekly MACD is bullish and stays above its sign line. A spinning prime occurred on the candles; this displays just a little value motion and little or no distinction between the open and the shut ranges of the week. This sort of candle additionally signifies an absence of directional bias that prevailed during the last 5 days.

The sample evaluation of the weekly chart reveals that the principle breakout that occurred when the NIFTY moved previous the 15900-15950 zone continues to be very a lot in drive. After every transfer on the upper aspect, the markets have consolidated for a while, solely to renew their uptrend. As of now, this short-term base has shifted on the 17000 ranges, that are anticipated to behave as a right away help degree if a corrective extra or a range-bound consolidation occurs.

The FMCG and the Consumption indexes have been buying and selling robust. Nevertheless, some underperformance continues to be seen in sectors like Auto, Banks and choose Pharma and the PSE shares. We count on these sectors to enhance their relative efficiency towards the broader markets over the approaching week. We suggest avoiding aggressive shorts and keep very selective whereas making new purchases. All earnings on both aspect needs to be vigilantly protected even because the broader main development stays intact.

Sector Evaluation for the Coming Week

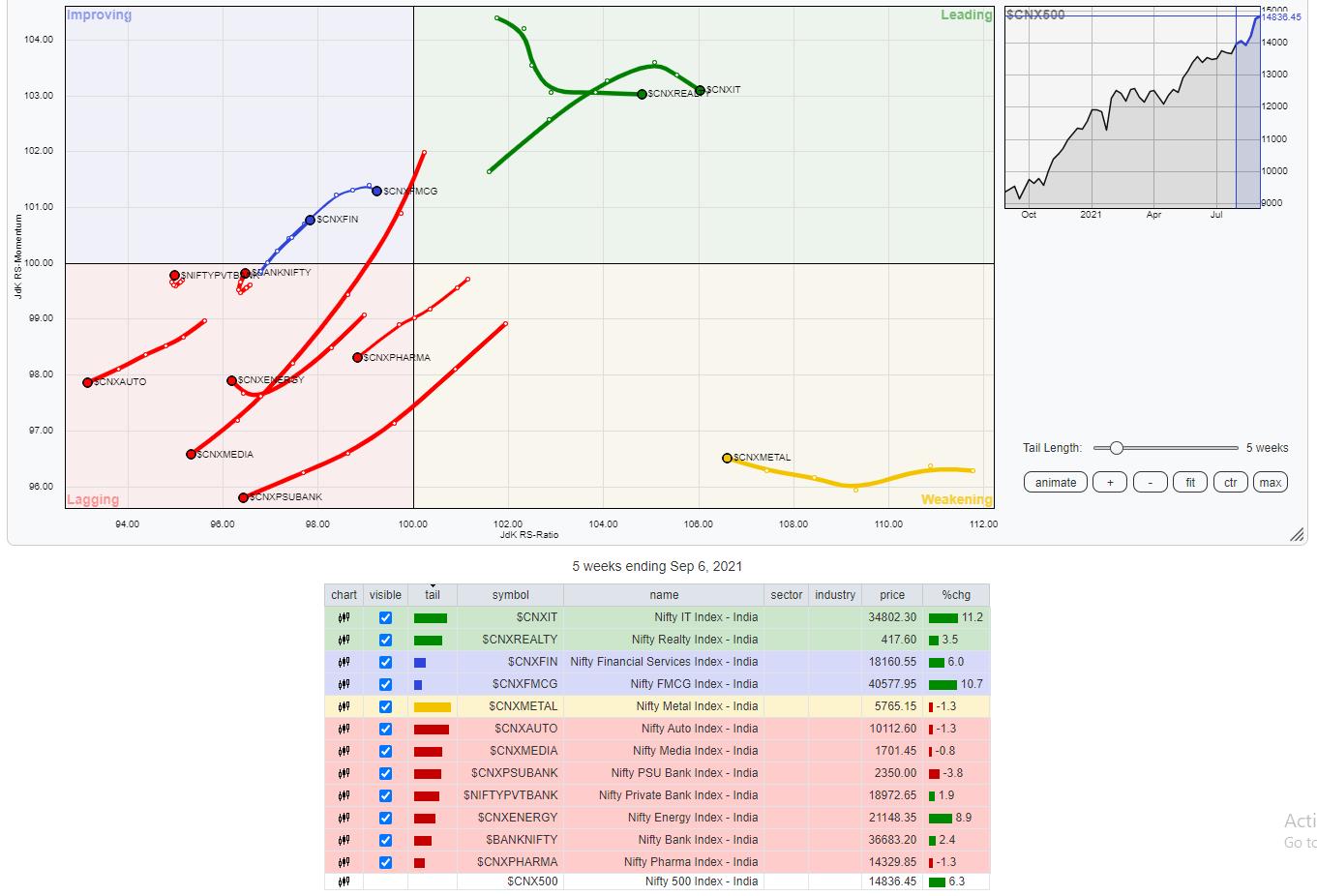

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) reveals that the NIFTY IT Index, Realty Index and the small-cap indexes are contained in the main quadrant; out of those, the Small Cap index is paring its momentum. Nevertheless, these teams are more likely to proceed comparatively outperforming the broader NIFTY 500 index.

The MIDCAP 100 Index, Commodities and the Metallic index are contained in the weakening quadrant. Though the Mid-cap index appears barely weak, all these three indexes are trying to consolidate their present relative underperformance.

The NIFTY Auto and Pharma Indexes proceed to languish contained in the lagging quadrant together with the Media Index. These teams are more likely to underperform the broader markets. PSU Banks, BankNifty and the Infrastructure, Vitality and PSE indexes are contained in the lagging quadrant as properly. Nevertheless, they seem like consolidating and bettering their relative momentum towards the broader markets.

The Monetary Providers Index, Providers Sector Index, Consumption and the FMCG pack stay agency contained in the bettering quadrant. It’s anticipated that these teams will proceed to indicate resilience towards the broader NIFTY 500 Index.

Necessary Be aware: RRG™ charts present the relative energy and momentum for a bunch of shares. Within the above chart, they present relative efficiency towards NIFTY 500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst,

Milan Vaishnav, CMT, MSTA is a professional Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Providers in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, at present in its fifteenth 12 months of publication.

Milan’s main obligations embody consulting in Portfolio/Funds Administration and Advisory Providers. His work additionally entails advising these Purchasers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas holding their actions aligned with the given mandate.

Learn More

Subscribe to Analyzing India to be notified at any time when a brand new submit is added to this weblog!

[ad_2]

Source link