[ad_1]

Ant Group updates

Signal as much as myFT Every day Digest to be the primary to learn about Ant Group information.

Beijing needs to interrupt up Alipay, the 1bn-plus-user superapp owned by Jack Ma’s Ant Group, and create a separate app for the corporate’s extremely worthwhile loans enterprise, in essentially the most seen restructuring but of the fintech big.

Chinese language regulators have already ordered Ant to separate the again finish of its two lending companies, Huabei, which is analogous to a conventional bank card, and Jiebei, which makes small unsecured loans, from the remainder of its monetary choices and herald outdoors shareholders.

Now officers need the 2 companies to be break up into an impartial app as effectively. The plan would additionally require Ant to show over the person information that underpins its lending selections to a brand new credit score scoring joint-venture which might be partly state-owned, in response to two folks conversant in the method.

“The federal government believes large tech’s monopoly energy comes from their management of knowledge,” stated one individual near monetary regulators in Beijing. “It needs to finish that.”

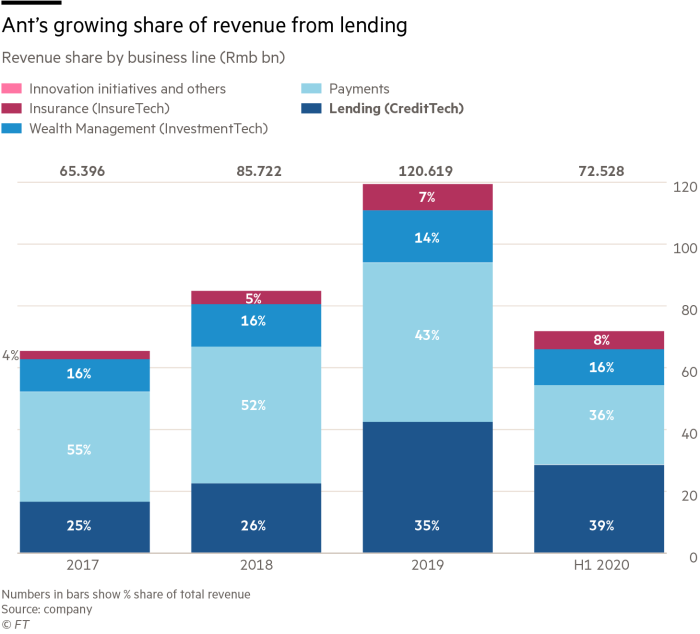

The transfer could decelerate Ant’s lending enterprise, with the big development of Huabei and Jiebei partly powering its deliberate IPO final 12 months. The CreditTech unit, which incorporates the 2 items, overtook Ant’s major fee processing enterprise for the primary time within the first half of 2020, to account for 39 per cent of the group’s revenues.

The dimensions of the unit, which helped to subject about one-tenth of the nation’s non-mortgage client loans final 12 months, stunned regulators who fretted about predatory lending and monetary threat.

Alibaba shares fell as a lot as 5.9 per cent in Hong Kong buying and selling on Monday. The Cling Seng Tech index, which tracks the most important Chinese language tech teams listed within the metropolis, shed 3.4 per cent within the face of renewed regulatory strain on the sector.

Ant has been battling regulators for management of the brand new three way partnership, however a compromise was reached below which state-owned corporations in its residence province, together with the Zhejiang Tourism Funding Group, would maintain a majority stake.

The provincial authorities did Ant a favour by pushing for native state-owned teams to develop into its new companions, the folks stated.

“Given the mutual belief between Ant and Zhejiang, the fintech group can have a giant say on how the brand new JV operates,” stated a former official on the Folks’s Financial institution of China. “However the brand new set-up may even be sure that Ant listens to the get together in the case of essential decision-making.”

An individual near Ant stated that in the meanwhile Ma’s workforce could be on the helm of the brand new enterprise. “What does Zhejiang Tourism Funding Group learn about credit score scoring — nothing,” the individual stated, whereas noting Ant executives had been nonetheless involved they may lose management sooner or later.

Reuters first revealed the make-up of the three way partnership reporting that Ant and Zhejiang Tourism Group would every take 35 per cent stakes with different state-owned and personal companions allotted smaller shares.

The brand new enterprise will apply for a client credit score scoring licence, which Ant has lengthy coveted. China’s central financial institution has issued solely three licences — all to state-run operations — stopping Ant from absolutely monetising the huge reams of knowledge it has collected on Chinese language residents.

However below the plan being thought-about, Ant will lose its capability to independently assess debtors’ creditworthiness. For instance, a future Alipay person in want of credit score would see their request first routed to the brand new three way partnership credit score scoring firm the place their credit score profile is held after which on to the brand new Huabei and Jiebei lending app to subject the credit score.

At present the method is completely built-in inside Alipay and Ant stated it made “credit score selections inside seconds” in its prospectus for its suspended IPO. The corporate didn’t reply to an emailed request for remark.

Ant is not going to be China’s solely on-line lender affected by the brand new guidelines. This summer time the central financial institution advised business gamers that lending selections have to be made based mostly on information from an authorised credit score scoring firm relatively than proprietary information, one of many folks stated.

A senior government at a distinct on-line lender stated this might translate right into a “reasonable” lower of their margin because the agency might now not use its personal information to make lending selections.

Further reporting by Hudson Lockett in Hong Kong

#techAsia weekly e-newsletter

Your essential information to the billions being made and misplaced on this planet of Asia Tech. A curated menu of unique information, crisp evaluation, sensible information and the newest tech buzz from the FT and Nikkei

Enroll right here with one click on

[ad_2]

Source link