[ad_1]

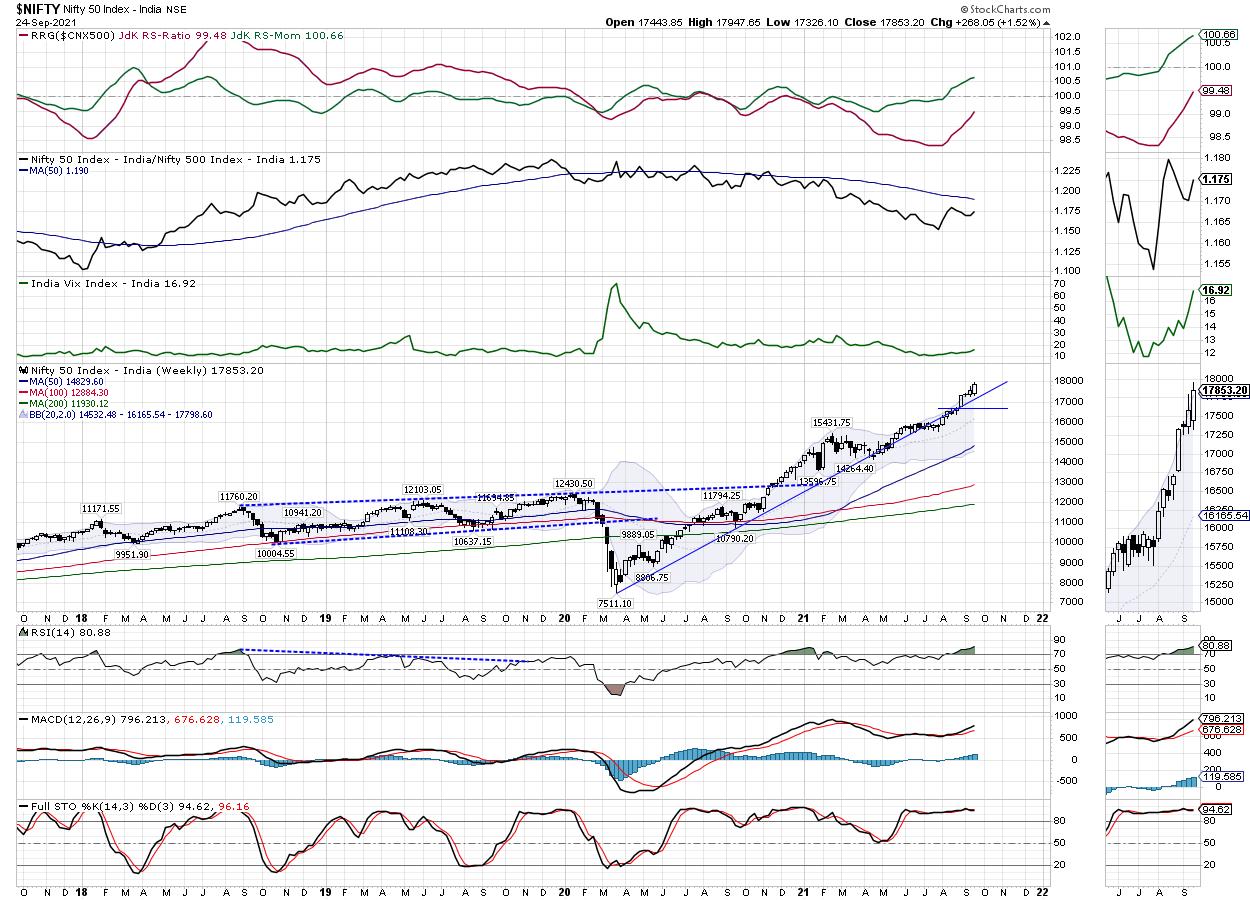

A lot on the anticipated strains, the Indian fairness markets had a powerful week. Regardless of being overbought and a bit overextended on the charts, the shares put up a resilient present whereas the NIFTY examined and closed at a contemporary lifetime excessive level. The Indian markets had been one of the vital resilient amongst its friends; it has gone on to comparatively outperform a lot of the markets. All of the 5 days of the week had been trending classes with little or no and short-lived consolidation that happened. The buying and selling vary additionally remained wider on the anticipated strains; the NIFTY traded in a 621.55 factors wide selection over the earlier week. The headline index lastly ended with a internet achieve of 268.05 factors (+1.52%) on a weekly foundation.

The approaching week is about to be essential for the NIFTY. The choices knowledge means that the frontline index could consolidate given very excessive accumulation of Name OI between 17800-18000 factors. This will forestall NIFTY from any runaway rise; nevertheless, a take a look at BankNIFTY and different sector Indexes like PSU Banks, PSE, and many others., exhibits a terrific chance of those pockets beginning to comparatively outperform the NIFTY in addition to the broader NIFTY500 index. The volatility additionally elevated; INDIAVIX rose by 11.09% to 16.92 on a weekly foundation. The markets, i.e., entrance line index like NIFTY could are available in underneath consolidation; the choose pockets within the markets nonetheless have some extra steam left in them.

The approaching week will see the degrees of 17900 and 18030 enjoying out as resistance factors. The helps are available in at 17760 and 17600 ranges. Opposite to what was anticipated over the earlier weeks, the buying and selling vary could get narrower this time if NIFTY heads in the direction of consolidation.

The weekly RSI is at 80.88; it has made a contemporary 14-period excessive, which is bullish. It stays within the overbought zone; nevertheless, it additionally stays impartial and doesn’t present any divergence towards the worth. A robust white candle emerged; this displays a powerful directional consensus of the market members on the upside.

All and all, the markets proceed to stay overextended on each the quick time period in addition to the long-term charts. Nevertheless, the inner power of the markets stays intact as of now; no indicators have emerged that time in the direction of any main weak point over the approaching days. Solely factor that’s doubtless is the NIFTY present process an outlined broad consolidation which can not solely see NIFTY transferring in an outlined vary, however some elevated volatility as effectively. Within the given technical setup, any contemporary sustainable up transfer shall happen provided that the NIFTY strikes previous 17940 ranges convincingly. Till this occurs, we’re in for some range-bound consolidation.

Nevertheless, throughout such instances, we’ll discover different sectors staging a resilient efficiency. These are more likely to be these sectors which have been both underneath consolidation or these which can be seeing improved relative power towards the broader markets. We advocate avoiding shorts except a particular signal of any weak point emerges. Alternatively, whereas staying extremely selective, a cautious strategy with vigilant safety of income is suggested for the day.

Sector Evaluation for the approaching week

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that the Small Cap index, that resides contained in the main quadrant is slowly paring its relative momentum. The Realty and the IT indexes are positioned contained in the main quadrant and are set to proceed to comparatively outperform the broader markets.

NIFTY FMCG, Consumption, Monetary Companies, Infrastructure, and Infrastructure Indexes are contained in the bettering quadrant; they’re additionally seen rotating in northeast course and seems to be transferring in the direction of the main quadrant. These teams are additionally set to place up a resilient present in comparison with the broader markets.

BankNIFTY index has rolled contained in the bettering quadrant. This hints at a probable finish to its relative underperformance towards the broader NIFTY500 index.

The Metals, MIDCAP 100 and the Commodities index stays within the weakening quadrant.

The Pharma is the one index seen languishing contained in the lagging quadrant. The opposite indexes like Vitality, Media, Auto, PSU Financial institution, and the PSE indexes are additionally contained in the lagging quadrant. Nevertheless, they’re seen bettering on their relative momentum towards the broader markets.

Necessary Notice: RRG™ charts present the relative power and momentum for a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a professional Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, at the moment in its fifteenth yr of publication.

Milan’s major tasks embrace consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally entails advising these Purchasers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas preserving their actions aligned with the given mandate.

Learn More

Subscribe to Analyzing India to be notified every time a brand new publish is added to this weblog!

[ad_2]

Source link