[ad_1]

The broader markets have been struggling amid inflation and rate of interest fears which have collided with a worldwide power disaster. After peaking in value in early September, the S&P 500 has been in a downtrend that it has been struggling to reverse. Not all areas are seeing promoting, nevertheless, as Oil and Financial institution shares have seen substantial beneficial properties over the previous 4 weeks. In truth, subscribers to my MEM Edge Report have seen beneficial properties as excessive as 30% among the many eight shares in these 2 teams that we have highlighted as sturdy buys.

Different areas are additionally bucking the final downtrend, reminiscent of corporations that profit from spending on defense-related tasks that can happen regardless of a doable uptick in rates of interest or inflation. Particularly, the Area Improvement Company (SDA) has been constructing a system of surveillance satellites that act as a monitoring layer to detect missile launches whereas additionally performing battle administration plans for warfighters on the bottom. At full power, this transport layer is anticipated to supply protection to 99% of the Earth’s floor.

The result’s a necessity for 144 satellites — with the SDA seeking to rent a number of distributors who would wish to start deployment inside three years. Bidding from protection contractors was due in the present day with the awards being introduced in January. Under are three corporations anticipated to bid on these profitable contracts and, judging from their charts, traders are anticipating a optimistic consequence.

DAILY CHART OF L3HARRIS TECHNOLOGIES (LHX)

Frontrunner L3Harris Applied sciences (LHX) has a leg up as the corporate obtained SDA approval of their satellite tv for pc design plans late final month. The corporate has been concerned in different cutting-edge areas of expertise, with their robots being chosen to guard Air Power bases around the globe.

Final week, LHX reversed a current downtrend following a transfer again above its 50-day shifting common on quantity. The beneficial properties put the inventory on observe for a 1-month base breakout at $235. With a optimistic RSI and a bullish MACD crossover, the inventory is poised for additional upside.

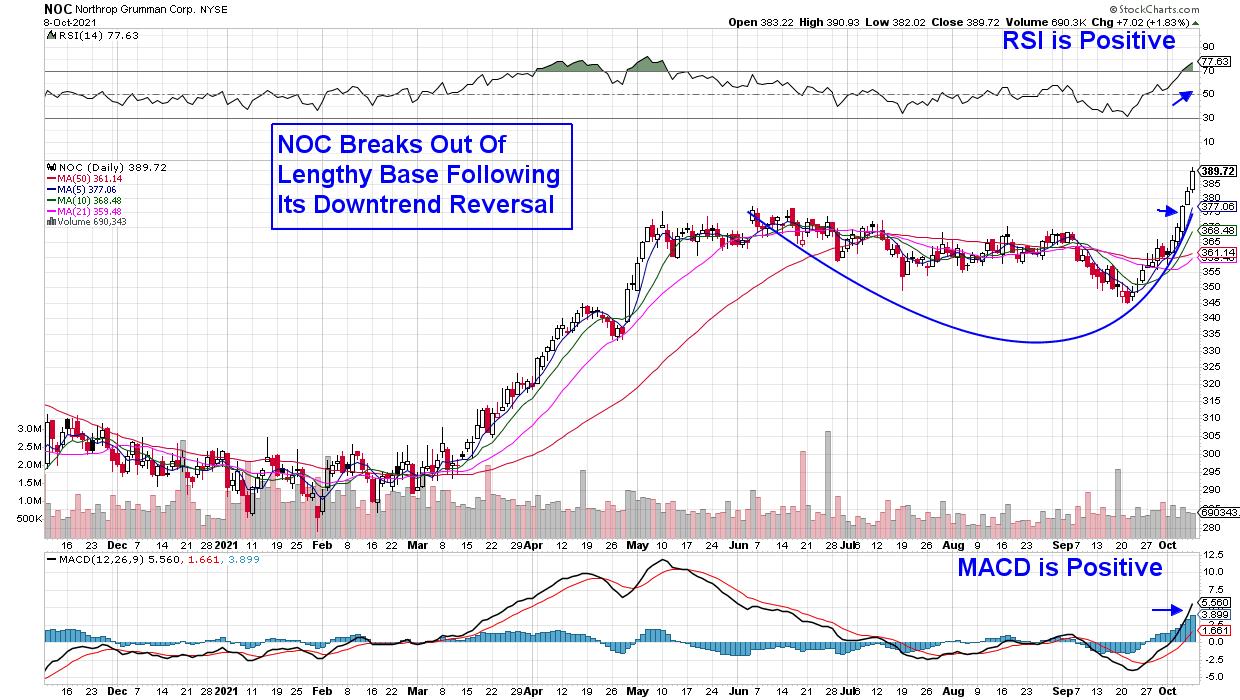

DAILY CHART OF NORTHROP GRUMMAN CORP. (NOC)

Northrop Grumman (NOC) elevated its lead as an area inventory after it bought rocket maker Orbital ATK in 2018. The corporate makes satellites in addition to the deep-space telescope for NASA.

NOC broke out of a 4-month base on quantity final week as analysts raised earnings estimates for each this yr and subsequent. Final week’s explosive transfer places the inventory in an prolonged place and, with the RSI and Stochastics in optimistic territory, it may be purchased on a pullback to its 5-day shifting common.

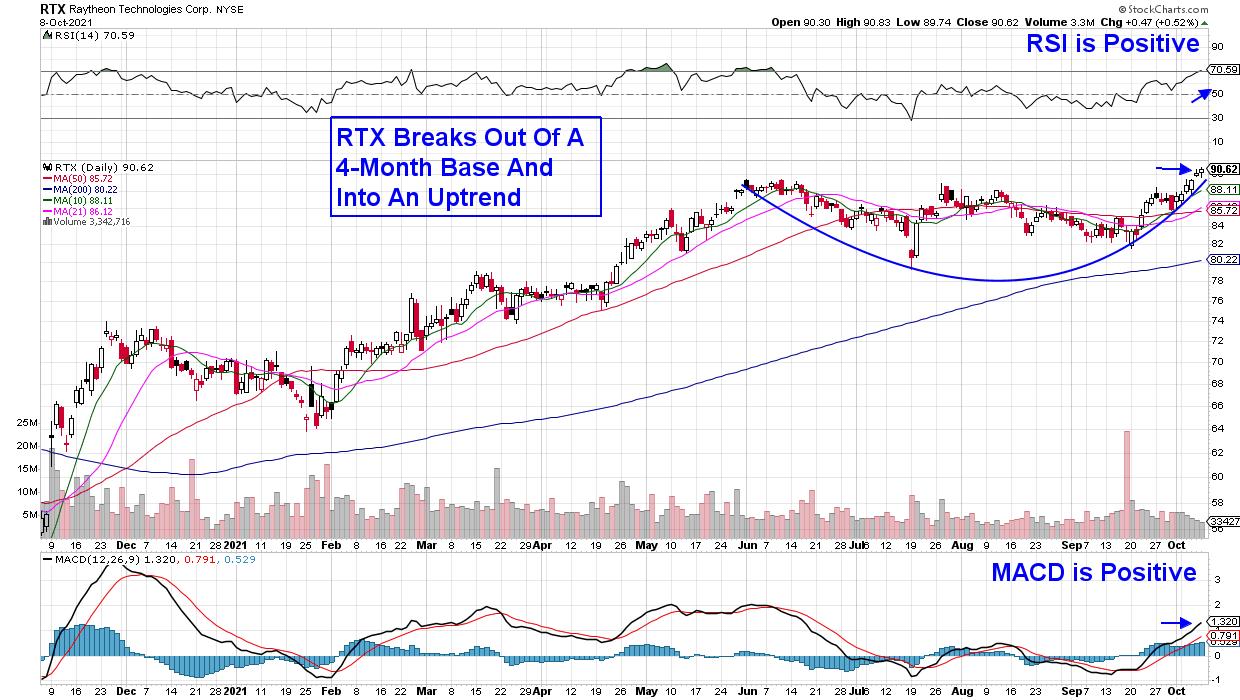

DAILY CHART OF RAYTHEON TECHNOLOGIES (RTX)

Raytheon (RTX) can be constructing out its house division with an announcement final month that they’ve bought a second firm that is a pacesetter in satellite tv for pc applied sciences. These corporations add to RTX’s already established Intelligence & Area division.

Raytheon broke out of a 4-month base and into an uptrend final week as the two.3%-yielder noticed estimates revised greater for this yr’s earnings. RTX is poised for additional upside with its RSI and MACD in optimistic territory.

A number of different well-known Protection-related corporations are within the operating to be chosen for the SDA’s satellite tv for pc challenge; nevertheless, their shares should not in confirmed uptrends at the moment. This would come with each Boeing (BA) and Lockheed Martin (LMT), that are buying and selling beneath their key 50-day shifting averages and nowhere close to a bullish base breakout.

In keeping with the confirmed methodology I take advantage of in my work, most main shares start their outperformance as they’re rising from a base breakout that is coupled with a powerful elementary driver. That is what pointed me towards main Expertise shares from June till September, and plenty of of those identical shares seem poised to regain their uptrends this month.

If you would like to be alerted to those shares in addition to know exactly when the broader markets have turned bullish, take a 4-week trial of my bi-weekly MEM Edge Report for a nominal payment now.

On this week’s edition of StockCharts TV’s The MEM Edge, I overview areas of the market which can be in confirmed uptrends, with additional upside forward and what areas to keep away from. She additionally highlights what to be looking out for to verify that the broader markets are secure.

Warmly,

Mary Ellen McGonagle

President, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Learn More

Subscribe to ChartWatchers to be notified each time a brand new submit is added to this weblog!

[ad_2]

Source link