[ad_1]

This has been a complicated market in so some ways. The S&P 500 moved greater for the primary 9 months of the yr, however many shares had a really completely different expertise over that time-frame. Management themes have rotated a variety of occasions, with growth- and value-oriented sectors each spending time on the high of the checklist.

Within the final six weeks, we have skilled a dramatic selloff (of solely 6% off all-time highs) after which an equally dramatic restoration (of about 200 S&P factors). So what’s subsequent?

I just lately posted a video outlining four potential scenarios for the S&P 500 between now and year-end. Test it out and let me know which consequence you assume is almost definitely and why!

One in all my favourite components of my position at StockCharts is how I get to check notes with some very gifted technical analysts and strategists. Listed here are 4 of the charts which have come up just lately in these discussions, every of that are displaying extra of a bullish tilt and are reminding me to not be too detrimental within the face of bullish proof!

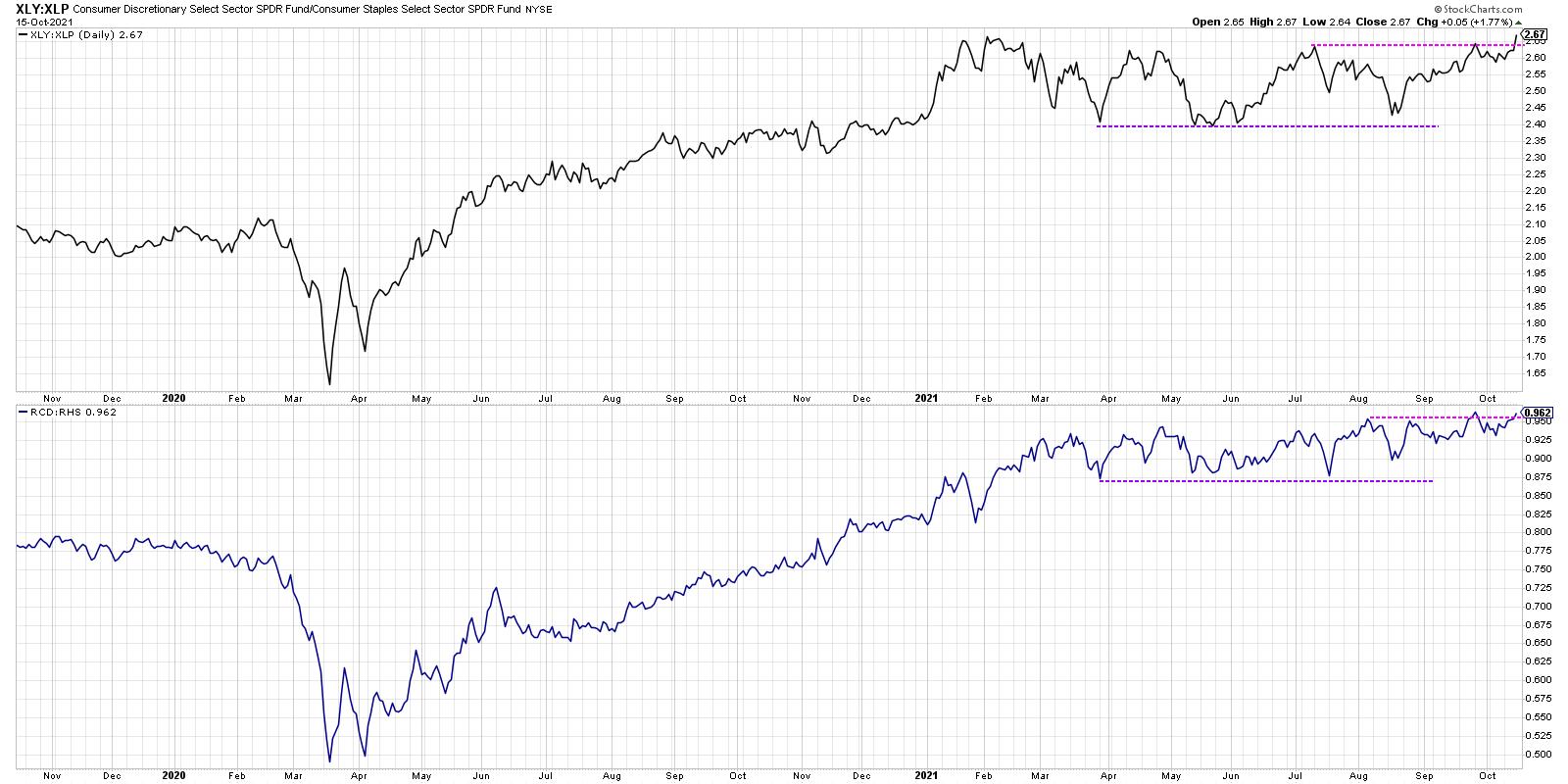

First, we’ve got the offense vs. protection ratio.

One in all my Constancy predecessors, Invoice Doane, had a model of this chart within the Constancy Chart Room. It was a technique to monitor institutional rotation between the offensive and defensive ends of the buyer area. The highest panel makes use of the cap-weighted model with the XLY and XLP. The underside panel is much more illuminating as a result of it use equal-weighted ETFs for every sector, RCD and RHS.

The XLY is dominated by three shares: AMZN, HD and TSLA. The equal-weighted model removes this chubby and is a greater measure of total rotation between the 2 sectors. As you possibly can see, each of those ratios are at or close to new highs this week. So, whereas the S&P 500 stays a bit under its all-time excessive round 4550, these ratios are displaying that buyers are nonetheless very a lot positioned for additional upside.

Second, let us take a look at the copper to gold ratio.

On this week’s particular occasion on StockCharts TV, “Chart Madness Revisited”, I had an absolute blast debating inventory picks and evaluating charts with Tom Bowley, Greg Schnell and Grayson Roze.

By the best way, you possibly can nonetheless entry the brackets and fill out your individual here!

At one level, we bought to the subject of the Supplies sector and Tom talked about the copper to gold ratio, which will be a good way to gauge financial power. In sturdy financial situations, there tends to be extra demand for copper and the ratio tends to maneuver greater. Be aware how this ratio has rotated from the extra defensive gold to the relative “offense” of copper, making a brand new excessive once more this week. The upper this ratio goes, the extra it speaks to upside potential for financial situations.

Third, we are able to take a look at rates of interest and the way that pertains to sector management.

The ten-year yield has risen again to the 1.50-1.75 vary, the place it was again in March via June of this yr. 1.75 definitely might serve resistance for the $TNX, however a break above this stage would clear the best way to 2% or greater assuming an extra deterioration in bond costs.

Why are charges so essential?

The underside ratio exhibits the Monetary sector versus the Know-how sector. The relative power of the XLF could be very intently aligned with ten-year yields. If and when charges proceed greater, that might be an enormous tailwind for banks and large headwind for progress sectors like Know-how.

On the finish of our Chart Madness Revisited particular, I requested every of the consultants to offer their greatest concept between now and year-end. Out of the 16 shares within the authentic bracket, I chosen JPM primarily based in no small half on the chart featured above!

Remember to vote on which of those 4 S&P situations you see taking part in out between now and yr finish!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free course on behavioral investing!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator, and don’t in any approach signify the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing danger via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Learn More

Subscribe to The Aware Investor to be notified at any time when a brand new publish is added to this weblog!

[ad_2]

Source link