Fentanyl-related tariffs are likely a focus for China

In Stockholm, Beijing will likely demand the removal of the 20% fentanyl-related tariff that Trump imposed earlier this year, said Sun Yun, director of the China program at the Washington-based Stimson Center.

This round of the U.S.-China trade dispute began with fentanyl, when Trump in February imposed a 10% tariff on Chinese goods, citing that China failed to curb the outflow of the chemicals used to make the drug. The following month, Trump added another 10% tax for the same reason. Beijing retaliated with extra duties on some U.S. goods, including coal, liquefied natural gas, and farm products such as beef, chicken, pork and soy.

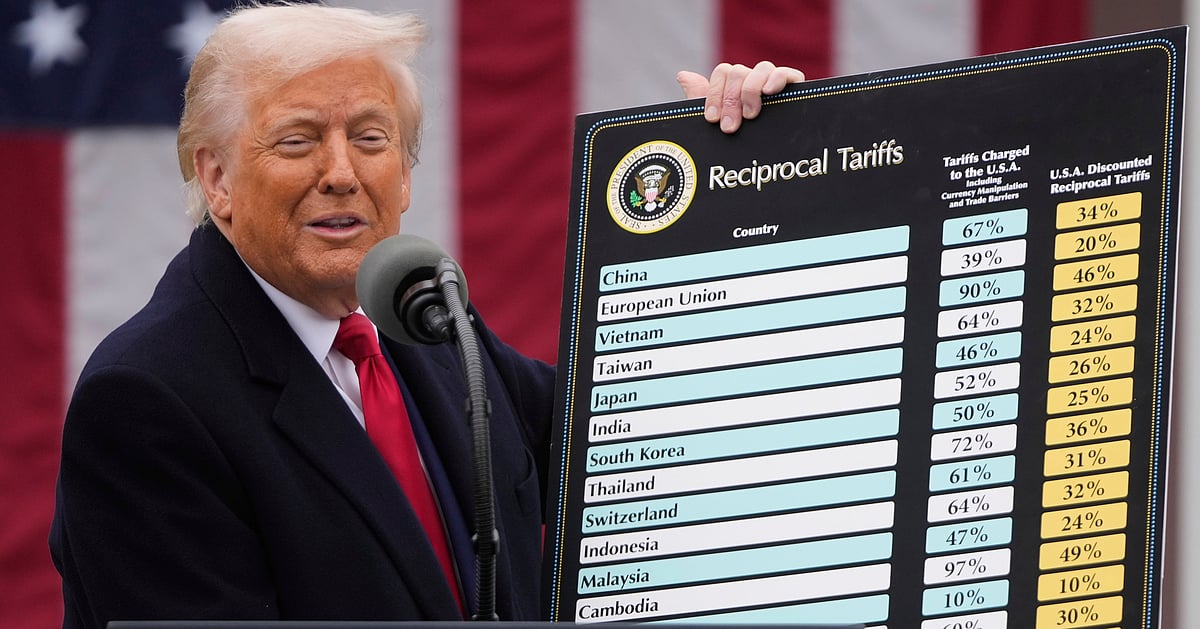

In Geneva, both sides climbed down from three-digit tariffs rolled out following Trump’s “Liberation Day” tariffs in April, but the U.S. kept the 20% “fentanyl” tariffs, in addition to the 10% baseline rate — to which China responded by keeping the same 10% rate on U.S. products. These across-the-board duties were unchanged when the two sides met in London a month later to negotiate over non-tariff measures such as export controls on critical products.

The Chinese government has long protested that American politicians blame China for the fentanyl crisis in the U.S. but argued the root problem lies with the U.S. itself. Washington says Beijing is not doing enough to regulate precursor chemicals that flow out of China into the hands of drug dealers.

In July, China placed two fentanyl ingredients under enhanced control, a move seen as in response to U.S. pressure and signaling goodwill.

Gabriel Wildau, managing director at the consultancy Teneo, said he doesn’t expect any tariff to go away in Stockholm but that tariff relief could be part of a final trade deal.

“It’s possible that Trump would cancel the 20% tariff that he has explicitly linked with fentanyl, but I would expect the final tariff level on China to be at least as high as the 15-20% rate contained in the recent deals with Japan, Indonesia, Vietnam,” Wildau said.