BAKU, Azerbaijan, November 24. Azerbaijan’s

financial system is entering a new era defined by digital

transformation, modern regulatory frameworks, and inclusive

financial policies. Amid these changes, Islamic banking, a

faith-based, interest-free financial model, is catching the eye not

just for its adherence to religious tenets but also for its sound

economic reasoning, risk-sharing strategies, and backing of the

real sector.

Once discussed theoretically, Islamic banking in Azerbaijan has

moved to practical implementation through legal frameworks,

research, and pilot initiatives. According to the “Financial Sector

Development Strategy for 2024-2026” approved by the Central Bank of

Azerbaijan (CBA), measures are underway to establish a functioning

Islamic banking system. Recent statements from the CBA,

international credit rating agencies, and experiences of regional

countries indicate that Azerbaijan is really putting its best foot

forward in embracing this new financial philosophy.

Why is the new financial model so relevant?

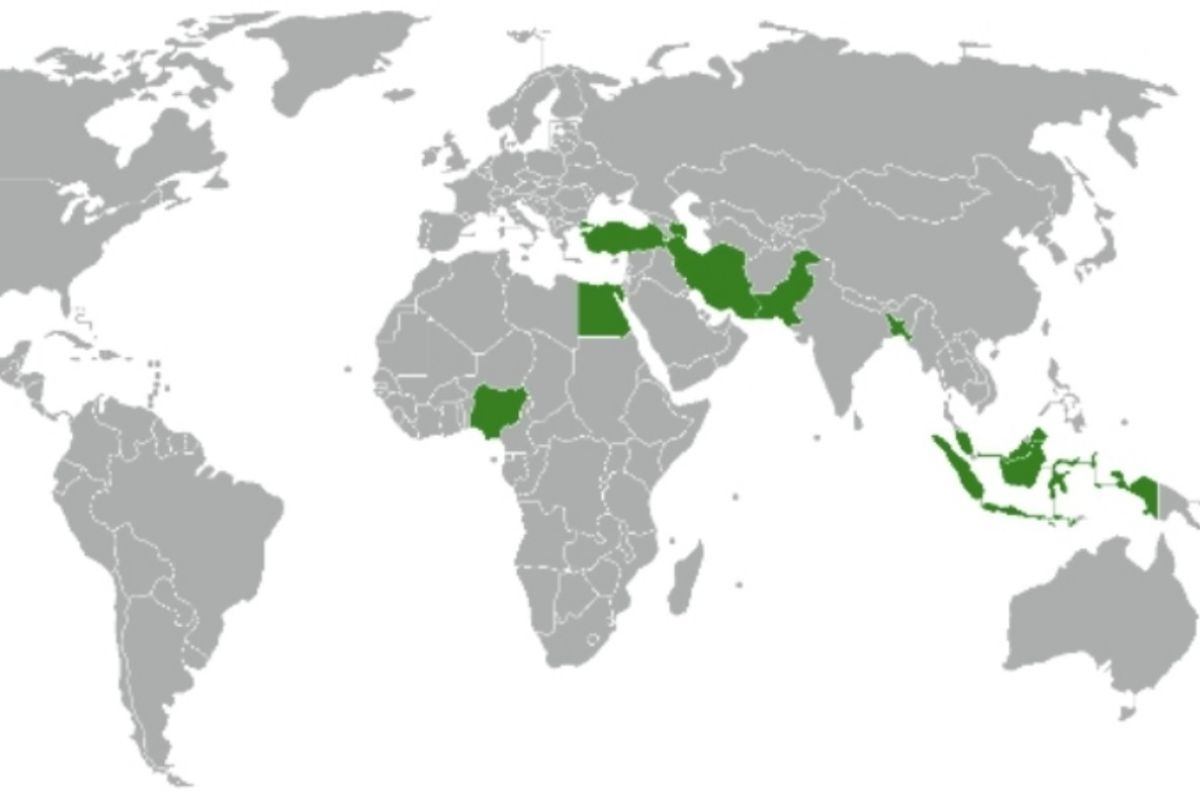

With established ecosystems in Malaysia, Indonesia, the United

Arab Emirates, Saudi Arabia, and Türkiye, Islamic banking is one of

the fastest-growing financial systems globally. The system is built

on principles of interest prohibition, risk-sharing, real-sector

financing, and financial equity. Its popularity stems not only from

compliance with Sharia principles but also from its potential to

foster stable and sustainable economic growth.

In Azerbaijan, this model is particularly relevant because a

significant segment of the population avoids interest-based loans,

and small and medium enterprises (SMEs) face financing challenges.

The country also provides favorable conditions for leadership in

Islamic finance. As a result, the banking sector is exploring new

income streams and less speculative opportunities, making Islamic

banking a real demand rather than a theoretical concept.

The CBA Approach: “Understanding Demand

First”

Taleh Kazımov, Chairman of the CBA, stressed that getting a

handle on demand is the name of the game before rolling out a

big-time model.

“To establish a broad model, we must first assess demand. This

is not a sector to implement hastily,” Kazımov said.

He added that the CBA’s “Islamic window” concept is designed

precisely for this purpose, allowing pilot interest-free operations

within conventional banks to train the sector and reveal the

market’s potential.

An initial assessment conducted in 2022 indicated that demand

for Islamic finance in Azerbaijan could reach approximately 300

million manat ($176.4 million), representing a minimal starting

point.

“If the system works properly, this market is expected to grow

exponentially,” Kazımov noted.

This statement underscores that Azerbaijan’s banking sector is

on the brink of a transformative new era. Global experience shows

that Islamic finance is far more than an alternative credit model;

it represents a completely different financial philosophy, one that

is more transparent, emphasises risk-sharing, and incorporates

elements of social responsibility.

Significant legislative reforms are

anticipated

Implementing Islamic banking in Azerbaijan entails creating a

new financial ecosystem, requiring updates to the legal

architecture of the banking sector. Since Islamic finance does not

rely on traditional interest, the current legal framework is

insufficient. Consequently, amendments across a broad spectrum,

from the Civil Code to the Tax Code, are necessary.

Rustam Tahirov, Director of the Financial Sector Sustainable

Development Department at the CBA, confirmed that these legal

changes would be submitted to the government by the end of 2025.

One key measure involves exempting Islamic finance operations from

value-added tax (VAT), which would make interest-free financial

models economically competitive.

Tahirov highlighted that the issue of VAT exemption is, in fact,

the cornerstone of the entire process. Unlike traditional credit,

Islamic finance often involves a two-step operation: the bank first

purchases an asset and then sells it to the client. Under current

legislation, these transactions face additional taxation, which

reduces the model’s economic appeal. Removing this burden would

allow Islamic banking to establish itself in Azerbaijan not merely

as a tool for ideological or religious purposes, but as a fully

competitive financial instrument.

What is particularly noteworthy is the government’s systematic

approach to this initiative. This demonstrates that Islamic finance

is not viewed as a temporary or localised project in Azerbaijan. On

the contrary, the state sees it as a strategic opportunity to

diversify the economy, create new investment platforms, and

strengthen financial stability.

The legislative package set to be presented by the end of 2025

could represent the most significant legal transformation in the

country’s financial system in recent years. If implemented

successfully, Azerbaijan could become a regional, and even broader,

exemplar for the development of Islamic finance.

Phased implementation from 2025: “Islamic windows” move

into practice

The system’s initial form, “Islamic windows” operating within

conventional banks, is no coincidence. Globally, this is the

standard starting point. This stage has three main objectives: to

introduce interest-free products to customers, to build

methodological and operational expertise within the banking sector,

and to measure real demand while creating a statistical

foundation.

World experience shows that central banks in countries like

Pakistan and Türkiye provide direct support for this preparatory

phase, ensuring the system is launched effectively and

sustainably.

Moody’s: “A positive credit effect for

Azerbaijan”

The international rating agency Moody’s highlights that the

introduction of Islamic banking will open new revenue streams for

banks.

“In particular, it will become easier to attract funds from

Islamic finance institutions, long-term and stable financing will

be possible through sukuk issuance, and the liquidity of the

banking sector will be strengthened,” the agency noted.

Moody’s also emphasised a striking point, noting that the

majority Muslim population in Azerbaijan indicates immense

potential, but regulatory gaps have so far prevented this potential

from being realised.

A new boost for small and medium-sized enterprises

(SMEs)

SMEs play a crucial role in Azerbaijan’s economy, contributing

significantly to both economic output and employment. However,

access to financing remains a challenge. Islamic finance’s

risk-sharing instruments could provide fairer and more transparent

financial opportunities, supporting the expansion of

entrepreneurship and contributing to economic diversification.

Observers note that Azerbaijan is treading carefully and playing

its cards right as it makes the leap into Islamic banking, which is

just the ticket. The country is advancing on three fronts:

assessing real demand (i.e., what products are needed?), updating

the legal framework (i.e. without which implementation is

impossible), and training the banking sector while ensuring a

gradual and controlled adaptation of processes.

This approach suggests that the transformation will be long-term

and sustainable. The goal is not just to introduce new products but

to establish a fully-fledged new financial philosophy in

Azerbaijan.

In conclusion, Islamic banking has the potential to become a

cornerstone of a new economic stage. With careful preparation and

successful implementation of “Islamic windows,” 2025-2026 could

mark the beginning of a transformative era in Azerbaijan’s

financial history.

Stay up-to-date with more news on Trend News

Agency’s WhatsApp channel