[ad_1]

The S&P 500 posted its worst week since February, with each sector ending within the purple. The transfer factors to investor considerations about volatility as we head into the sometimes troublesome fall interval.

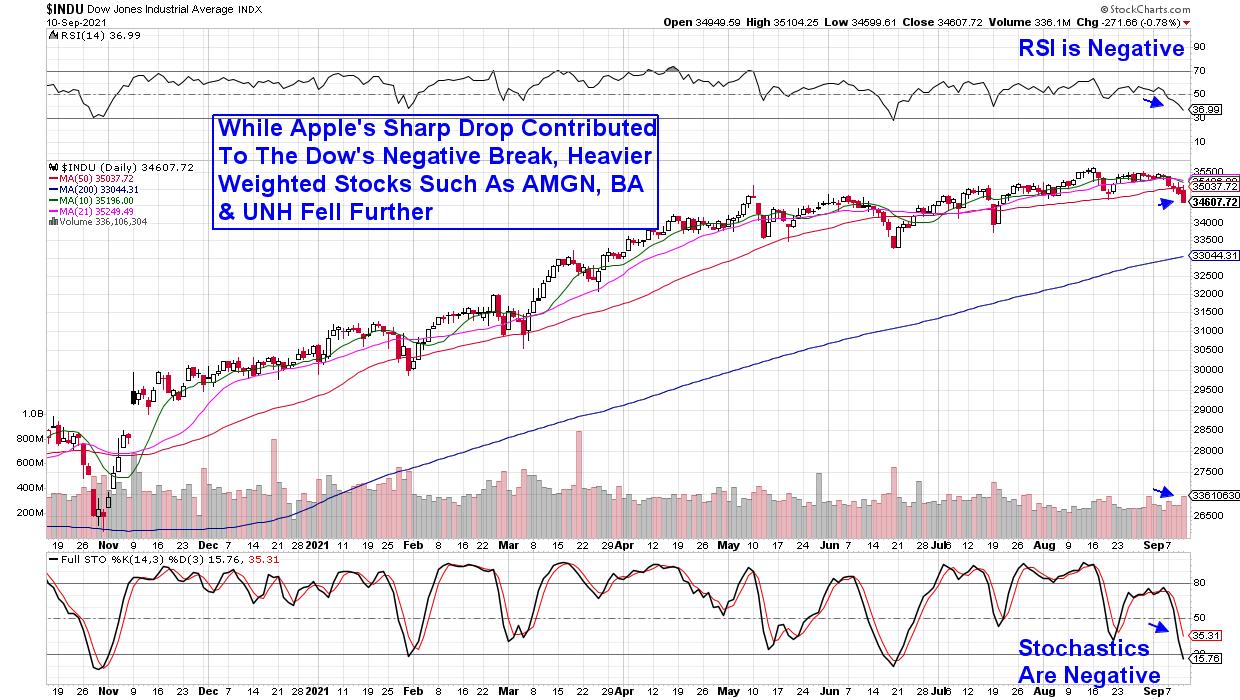

Whereas subscribers to my MEM Edge Report will attest to clear-cut pockets of energy, as most of our purchase candidates have greater than outpaced the S&P’s decline of 1.4% for the month, the continued narrowing of management areas is regarding. Final week’s unfavourable worth motion within the Dow Jones Industrial Common can also be value noting, because it closed the week under its key 50-day transferring common.

DAILY CHART OF DOW JONES INDUSTRIAL AVERAGE

Whereas the longer-term uptrend for the markets stays in place, having a recreation plan to buffer towards any additional potential weak point can be prudent at this juncture.

To start, you may need to pay shut consideration to these down days available in the market. Should you see a decline of greater than 0.2 within the Nasdaq or S&P 500 in greater quantity than the earlier session, it qualifies as a distribution day.* And if these distribution days cluster along with 4 or 5 over a number of weeks, this almost definitely alerts that shares have topped and are heading for a downturn.

After at the moment’s drop in quantity, the Nasdaq has a rely of 1 distribution day over the previous a number of weeks, whereas the S&P 500 didn’t see excessive sufficient quantity at the moment to qualify, which retains its rely a zero.

DAILY CHART OF ALKERMES, INC. (ALKS)

As for particular person shares, shorter-term buyers might need to take earnings in case your inventory breaks under near-term assist akin to its 10-day transferring common. Given the restoration we have seen in most pullbacks this 12 months, nonetheless, be ready to purchase that inventory again if it breaks again above its 10-day mav and it is a management title.

Alkermes Plc (ALKS), which is a recommended holding from my MEM Edge Report, is a major instance, as its latest break under its 10-day transferring common is near recovering its uptrend. Different shares akin to Crowdstrike (CRWD), which hit a brand new excessive in late August, are persevering with to float decrease after breaking under their 10-day transferring common. One distinction right here is that CRWD’s break was on above-average quantity, whereas ALKS was not. As well as, CRWD’s RSI and MACD are deteriorating from weaker ranges than ALKS.

DAILY CHART OF SHOPIFY (SHOP)

Longer-term buyers can use a month-to-month chart, which might preserve you in shares so long as they’re discovering assist above their 6-month transferring common. This method would preserve you in names akin to Shopify (SHOP), which has managed to realize 31% 12 months up to now regardless of its extremely unstable efficiency, which you’ll see above.

Whereas the markets could also be heading right into a interval of elevated volatility, protecting your management names that exhibit excessive progress prospects all through that interval will typically serve you effectively. One key part to this technique is that the Business Group that your inventory is part of stays in favor. There are many fast-growing Photo voltaic shares, as an illustration, however unfavourable group dynamics are holding them down.

For individuals who’d like to remain on prime of the broader markets in addition to Business Group and Sector energy, trial my bi-weekly MEM Edge Report for a nominal price. You may have fast entry to my most up-to-date stories which spotlight a choose group of management shares that every stay in uptrends.

As well as, I will be a visitor on this week’s Investing With IBD podcast on Wednesday, September sixteenth. We’ll be discussing the present market dynamics in addition to methods to include successful habits {of professional} cash managers.

For individuals who cannot make the reside broadcast, you need to use this hyperlink above to be despatched to the recording!

In this week’s episode of StockCharts TV’s The MEM Edge, I overview final week’s market motion to find out whether or not we’re in for rougher instances forward. I additionally spotlight methods to inform in case your inventory is pulling again or poised to move a lot decrease.

Warmly,

Mary Ellen McGonagle

Mary Ellen McGonagle is an expert investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to turn out to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Learn More

Subscribe to ChartWatchers to be notified every time a brand new publish is added to this weblog!

[ad_2]

Source link