[ad_1]

Apple, Inc. (AAPL) has been one of the analyzed shares within the Wyckoff Energy Charting pages. It’s the most important firm by market capitalization and has an enormous affect on the main inventory indexes. On March nineteenth of 2015 it was added to the (pre) historic Dow Jones Industrial Common changing into a ‘Bellwether’ inventory in all regards. Starting in 2019 it launched into a rising development that culminated with an upward acceleration right into a Shopping for Climax (BC) in 2020 (see weekly chart beneath). AAPL is at a most fascinating juncture right here and it’s time to do some Wyckoffian evaluation on this inventory.

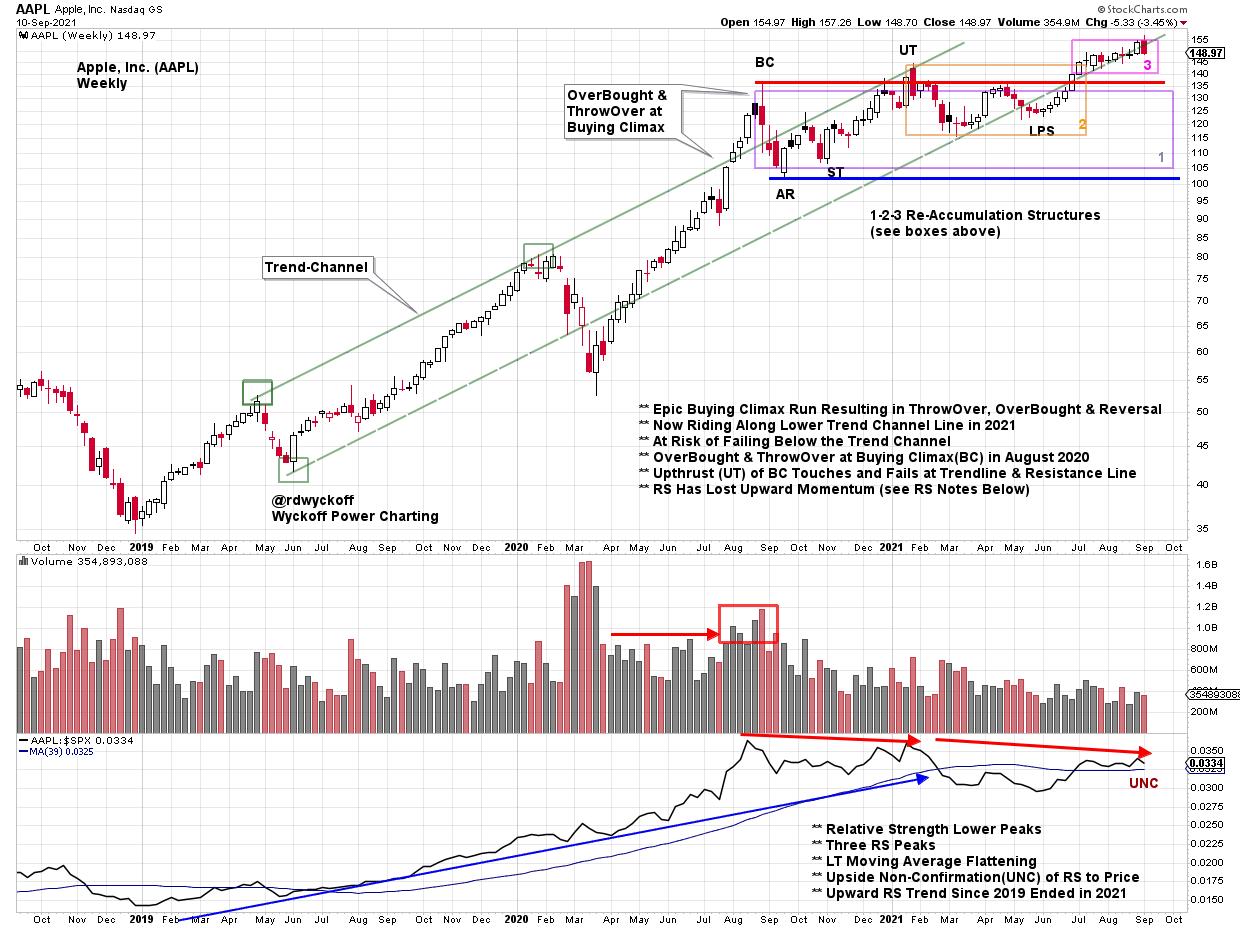

Apple, Inc. (AAPL) has been one of the analyzed shares within the Wyckoff Energy Charting pages. It’s the most important firm by market capitalization and has an enormous affect on the main inventory indexes. On March nineteenth of 2015 it was added to the (pre) historic Dow Jones Industrial Common changing into a ‘Bellwether’ inventory in all regards. Starting in 2019 it launched into a rising development that culminated with an upward acceleration right into a Shopping for Climax (BC) in 2020 (see weekly chart beneath). AAPL is at a most fascinating juncture right here and it’s time to do some Wyckoffian evaluation on this inventory.

Apple, Inc. Weekly with Three Re-Accumulations

Because the opening bell rang for the beginning of buying and selling in 2019, AAPL was rising right into a worth and relative power uptrend. From the March 2020 low the development accelerated right into a Shopping for Climax in late August, about one 12 months in the past. The Shopping for Climax threw over the rising development channel making a basic OverBought situation. Wyckoffians anticipate a Shopping for Climax and Computerized Response(AR) to sign a range-bound situation for worth for the foreseeable future. A Re-Accumulation construction is usually the results of such a buying and selling vary. It prepares the best way for the subsequent essential advance within the inventory (or index). Paradoxically Distribution and Re-Accumulation start in a like method. To date AAPL has had the character of Re-Accumulation with diminishing volatility, greater lows and an upward bias to the buying and selling vary construction. In June AAPL rallied up by the resistance, as outlined by the Shopping for Climax peak, and has been working greater since. As a ‘Bellweather’ AAPL has been doing the job of main the market indexes to greater costs since June.

Relative power topped on the Shopping for Climax peak and has been making subtly decrease highs since, not unusual during times of Re-Accumulation. The upward stride of RS for the reason that 2019 low demonstrated AAPL’s market performing management. Now a 12 months into Re-Accumulation, institutional buyers are keenly conscious of the mildly underperforming standing of AAPL through the prior 12 months, as outlined by a 12 months of decrease highs in Relative Energy.

Research the upward striding development channel for AAPL and the latest flirtation with the decrease channel trendline. Two essential technical ranges on the weekly chart are; 1) the prior resistance line (Shopping for Climax Degree) and a couple of) the decrease development channel line (the place worth now rests). We’ll watch intently for a doable break of each of those ranges as a technical worth failure, with the expectation that the development for this inventory remains to be upward, however in peril.

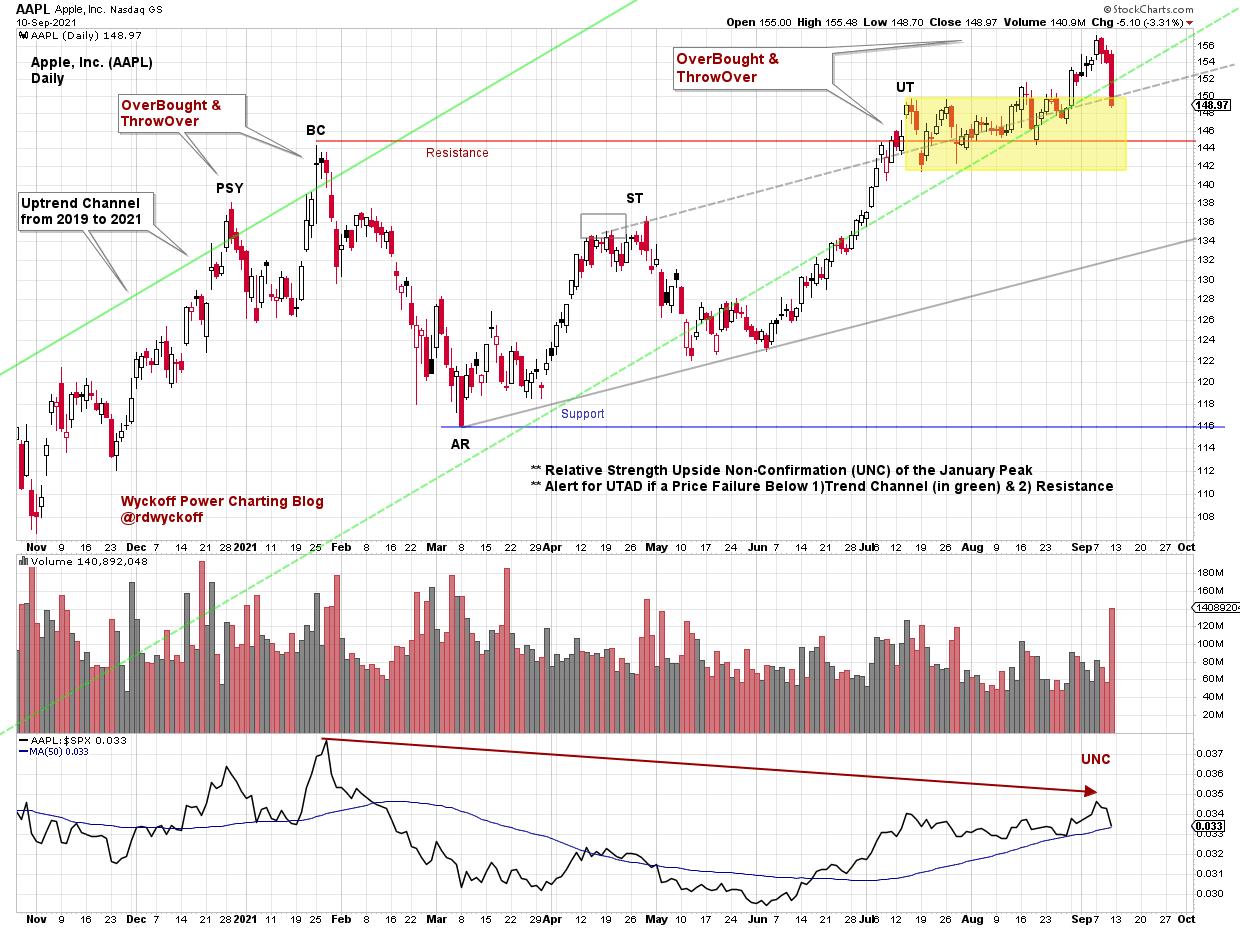

Apple, Inc. Every day

Zooming into the day by day view, a Preliminary Provide peak varieties at 12 months finish 2020 after which a Shopping for Climax (BC) in late January of this 12 months. A Resistance line is prolonged from the BC and a Assist line from the low of the Computerized Response (AR). Larger lows from the AR onward suggests a possible Re-Accumulation construction. The Backup (BU) and rally are making new worth highs, however up to now do not make new RS highs. An try to rally away from the Resistance line in July has been lackluster. The newest day by day worth bar is a pointy reversal downward on important quantity. Worth ought to maintain across the space of the Resistance line and never drop again into the Re-Accumulation vary.

Three Re-Accumulations have fashioned (see numbered packing containers on the weekly chart), and all have had breakouts (the third is profiled within the yellow shaded field on the day by day chart). A drop beneath the $137 worth stage will reverse all three of these constructions.

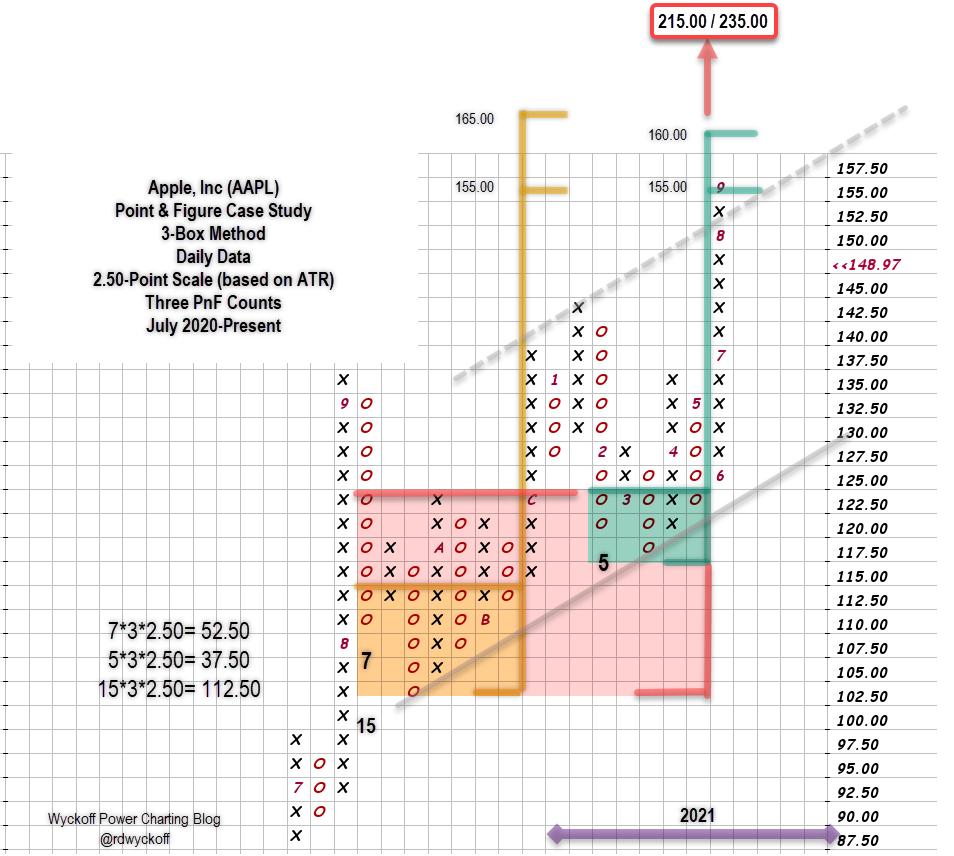

Apple, Inc. Level & Determine Case Research. 3-Field Methodology. 3 PnF Counts.

A Re-Accumulation with an upward stride has developed since final September. Three Level & Determine horizontal counts are thought of. Two inside counts (yellow and inexperienced shaded packing containers) are ‘Stepping Stone’ confirming counts to a spread of $155 to $165. The minimal goal of $155 has just lately been reached. Fulfilling these two confirming counts may signify a type of resistance for AAPL. A bigger depend (purple shading) stretches throughout the complete construction and reaches $215 / $235.

A abstract of the current place of Apple, Inc.

- AAPL is on the cusp of essential thresholds

- AAPL has rallied above the 12 months lengthy Re-Accumulation (weekly chart & PnF)

- AAPL has rallied above the 2021 Re-Accumulation (day by day chart)

- AAPL has rallied above a minor Re-Accumulation from July to September

- Relative Energy has been negatively diverging from worth since August 2020

- RS remains to be above a rising long run transferring common (weekly chart)

- Essential Assist ranges and trendlines are straight beneath present worth ranges ($144 to $137)

- The upward development is our buddy, whereas definable danger ranges are just under the present worth

- New product bulletins may generate rising demand

- If Re-Accumulation is full a brand new section of markup ought to speed up worth and RS greater

Any failure of worth by close by Resistance strains, Assist strains and trendlines on increasing volatility and quantity may sign an Upthrust After Distribution (UTAD)

As a management inventory AAPL may encourage a inventory market rally with a recent new uptrend. Re-Accumulation constructions are durations when shares pause and refresh for continuation of a previous advance. As is usually the case, shares get into precarious positions on the existential second when the development may pivot in both route. AAPL seems to be at this fascinating juncture.

All of the Greatest,

Bruce

@rdwyckoff

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Announcement:

TSAA-SF Annual Fall Convention. September 18th

The Technical Securities Analysts Affiliation of San Francisco (TSAA-SF) will host its annual fall convention on Saturday, September 18th. An All-Star listing of nice merchants and technical analysts will current at this 12 months’s occasion. Members of the TSAA-SF can attend with no extra cost and have entry to all recordings. If members can’t attend any a part of the dwell convention they’ll view it, any time on-demand. So turn out to be a member of this nice neighborhood of technicians and merchants as we speak and benefit from the glorious displays and content material all 12 months lengthy!

Be taught extra, turn out to be a member and register for the occasion right here:

Checklist of this 12 months’s presenters:

- Chris Kimble – founder and CEO of Kimble Charting Options

- Craig Johnson, CFA, CMT – Managing Director and Senior Technical Analysis Analyst at Piper Sandler Corporations

- Irusha Peiris, CMT – portfolio supervisor at O’Neil World Advisors

- Alessio Rutigliano – Wyckoff Methodology educator targeted on crypto markets

- Brett Steenbarger, Ph.D. – Professor of Psychiatry and Behavioral Sciences at SUNY Upstate Medical College in Syracuse, NY

- Ari H. Wald, CFA, CMT – Managing Director and head of Technical Evaluation at Oppenheimer

Bruce Fraser, an industry-leading “Wyckoffian,” started instructing graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Methodology. For practically three many years, he co-taught Wyckoff Methodology programs with Dr.

Learn More

Subscribe to Wyckoff Energy Charting to be notified each time a brand new put up is added to this weblog!

[ad_2]

Source link