[ad_1]

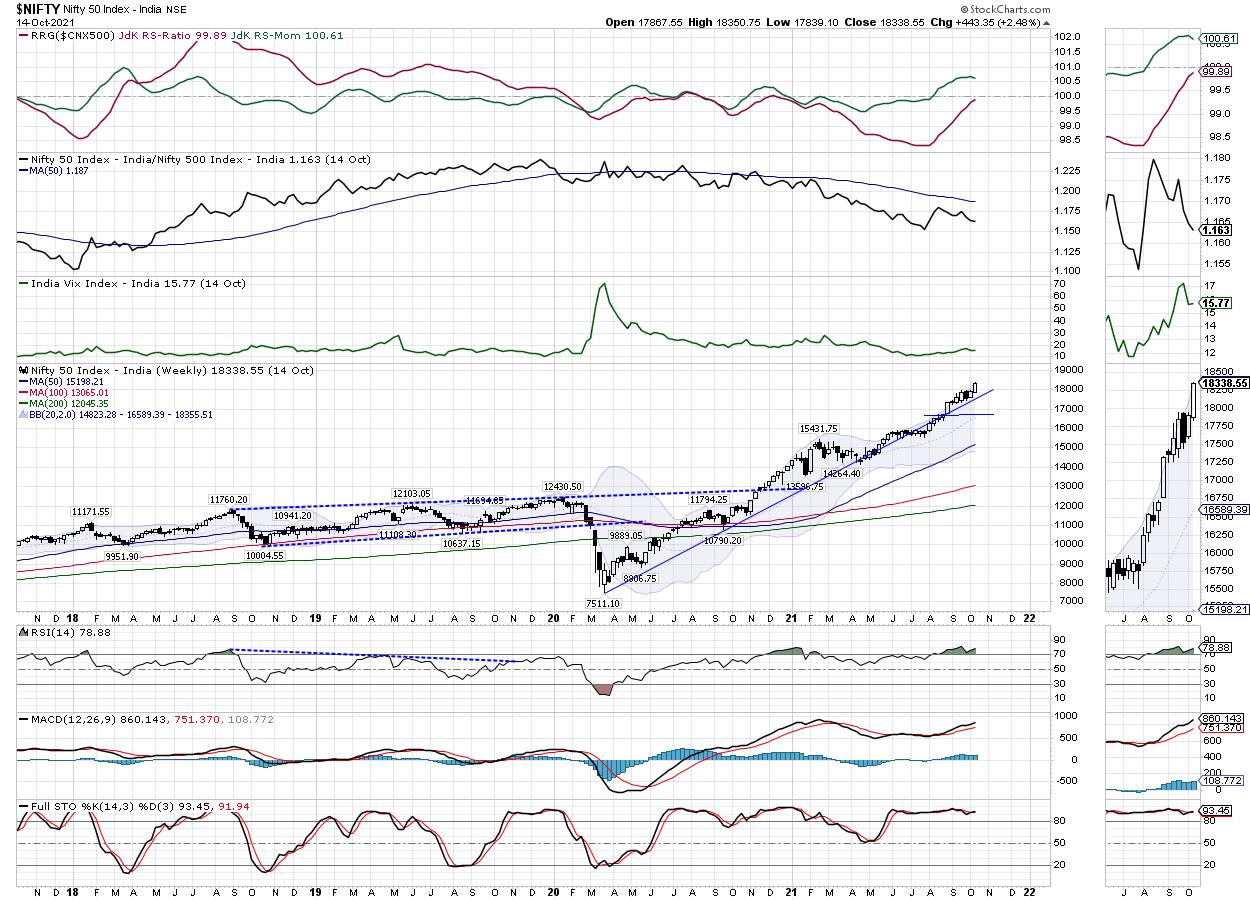

Within the interrupted week that was truncated on account of Dussehra on Friday, the Indian fairness markets traded very a lot on the anticipated and analyzed strains. Within the earlier be aware, it was talked about that given the construction of the technical patterns and the evaluation of F&O knowledge, the NIFTY is on the cusp of a recent breakout on the charts. Buying and selling on these strains, the NIFTY continued its surge forward within the 4-day buying and selling week; it went on to mark recent lifetime closing highs and managed to finish close to its excessive level of the week. The buying and selling vary over the week remained that of 511.65 factors. The headline index ended with internet good points of 433.35 factors (+2.48%) on a weekly be aware.

As soon as once more, from the technical perspective, NIFTY continues to remain buoyant. Trying on the quantity of Put writing being completed on the strikes of 18000 and above, and likewise trying on the quantity of Name unwinding happening on these similar very strikes, it clearly factors at sturdy undercurrents prevailing within the markets. This will not assure any unabated up strikes however definitely hints that if any consolidation or corrective strikes happen, they may keep restricted of their extent and stay range-bound. The NIFTY has shifted its short-term base a lot increased at 17900-18000 ranges.

The volatility remained almost unchanged; INDIAVIX rose marginally by 0.73% to fifteen.77. The approaching week is prone to see the degrees of 18500 and 18650 performing as potential resistance factors. The helps are available in at 18150 and 18000 ranges. The buying and selling vary over the subsequent 5 days is prone to keep a bit wider than normal.

The weekly RSI is 78.88; it continues to indicate a gentle detrimental divergence towards the value. It’s because whereas the value marked a 14-period excessive, the RSI didn’t. The MACD is bullish and above the sign line. A powerful white candle on the charts displays a directional consensus on the upside that prevailed in the course of the week.

The sample evaluation reveals that even when the day by day charts may look overstretched and overextended, the weekly charts don’t seem that method. In truth, apart from a minor violation for few weeks in between, the NIFTY is well monitoring the higher rising development line drawn from the lows of March 2020. Every time it has deviated from that development line, it has consolidated and reverted to its imply.

The approaching week reveals a excessive chance of the few sectors performing very properly with improved Relative Energy towards the broader markets. Even when the broader markets are inclined to consolidate, the sector-specific strikes in Realty, PSU Banks, choose non-public banks, monetary providers shares, Infrastructure, and Autos can’t be dominated out. We could even see Pharma pack making an attempt to consolidate its efficiency over the approaching days. Given the overbought nature of the markets, we suggest avoiding extra leverage, however shorts, in any case, must be prevented. A cautiously constructive outlook is suggested for the approaching week.

Sector Evaluation for the approaching week

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) reveals NIFTY Realty, IT, Consumption, Infrastructure, and Companies Sector Index positioned contained in the main quadrant of the RRG when benchmarked towards the broader NIFTY500 Index.

NIFTY MIDCAP50 is the one index positioned contained in the weakening quadrant. Nonetheless, that too is seen enhancing on its relative momentum towards the broader markets. The Metallic index has slipped contained in the lagging quadrant. Inventory-specific remoted efficiency could also be seen, however the index per se is prone to comparatively underperform the broader markets. An identical construction is seen with the Pharma Index positioned contained in the lagging quadrant.

NIFTY Auto and PSU Financial institution Index are additionally contained in the lagging quadrant. Nonetheless, they seem like significantly enhancing on their relative efficiency.

NIFTY Media and the Vitality indexes are seen making sturdy strides contained in the enhancing quadrant. Together with these teams, NIFTY FMCG, Monetary Companies, NIFTY Financial institution, and the PSE Sector Index are additionally positioned contained in the enhancing quadrant. These teams are prone to put up a resilient present over the approaching days.

Essential Word: RRG™ charts present the relative energy and momentum for a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

· For Premium Fairness Portfolio Advisory on Indian Shares, Click Here

· Alpha-generating actionable funding concepts on the US and UK Equities Click Here

· For Worldwide Commodities like Gold, Crude Oil and EURUSD/GBPUSD pairs Click Here

Milan Vaishnav, CMT, MSTA is a professional Unbiased Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly Publication, at present in its fifteenth 12 months of publication.

Milan’s major obligations embrace consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally entails advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas retaining their actions aligned with the given mandate.

Learn More

Subscribe to Analyzing India to be notified at any time when a brand new put up is added to this weblog!

[ad_2]

Source link